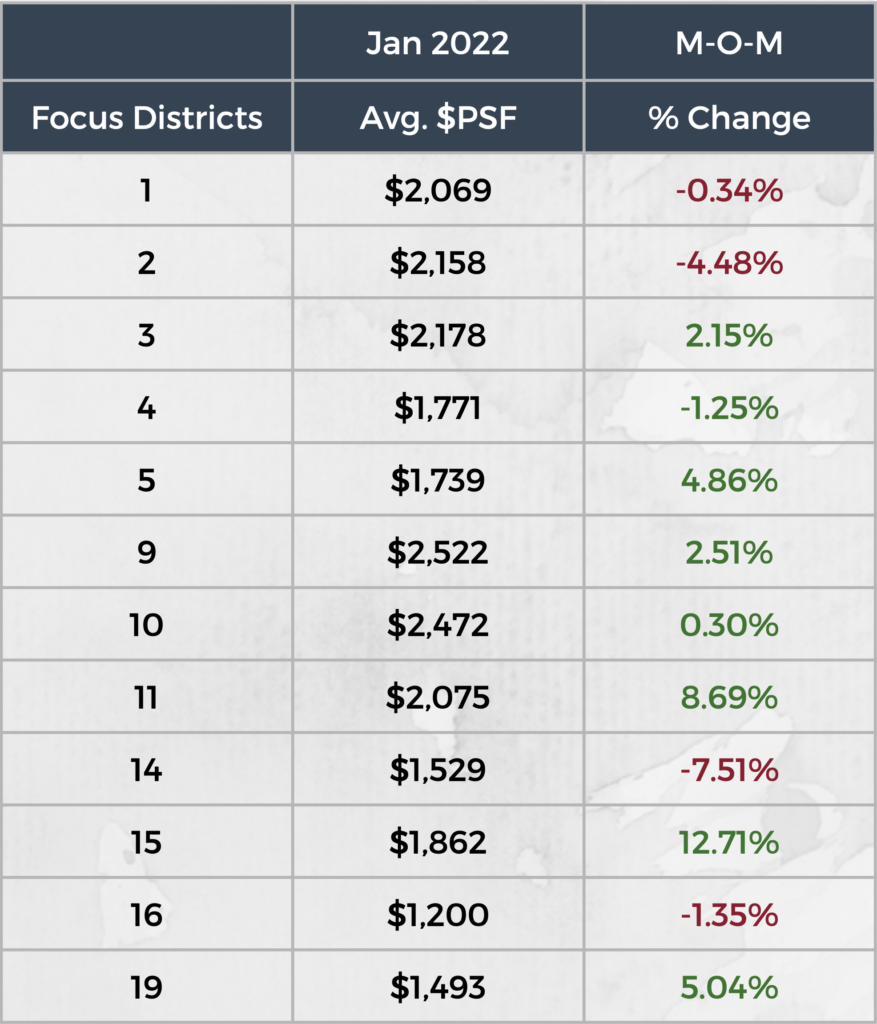

District 15 leads the pack with a 12.71% increase in prices

This is mainly due to the increase in new sale volume in Jan 2022 (42 units sold) compared to Dec 2021 (24 units sold). Amber Park was the best seller (18 units sold) with an average psf of S$2,438.

The biggest decrease was in District 14, with a 7.51% drop in psf prices

This was mainly due to the launch of Mori in Dec 2021 which saw 71 transactions with an average psf price of S$1,872, pulling the average up significantly in Dec 2021.

Districts 9, 10 and 11 saw a significant decrease in sales volume

Falling 37.7% in total for all 3 districts from 308 to 192 transactions. This is likely due to the latest round of cooling measures introduces in Dec 2021, as it affects the bulk of buyers in the 3 districts, namely foreigners and investors. They were hit hardest with the increase in ABSD. However, prices are still holding steady and resilient, with an increase in prices for all 3 districts despite the cooling measures.

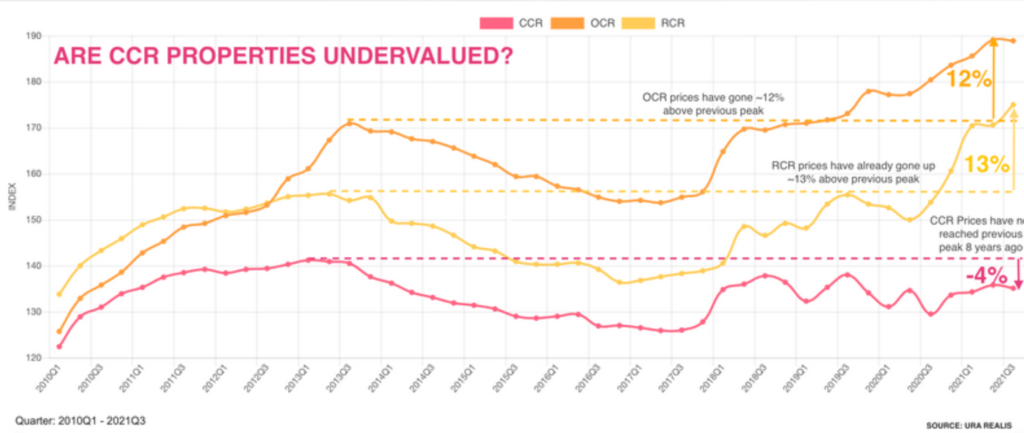

Are CCR Properties Undervalued?

RCR and OCR properties have surpassed their previous peaks by 13% and 12% respectively. Meanwhile, CCR properties have not yet hit the previous peak, showing signs of undervaluation and opportunity.

Demand for OCR and RCR regions have been fuelled by buyers who face construction delays and seek bigger spaces during this COVID-19 period due to its affordability.

With less demand from foreigners during the pandemic, properties in the CCR region are currently undervalued and there is a gap for its prices to catch up with other regions.