Looking to purchase your first private resale residential property in Singapore but you don’t know where to start, how to start or what to look out for? Fret not, because we are here to provide you a comprehensive guide on how to make your dream home purchase with a clear idea on the processes each step of the way.

Below are the 10 comprehensive step-by-step guide on the whole purchase process of your private resale property!

Step 1: Eligibility Check

Step 2: Financial Planning

Step 3: Start your home shopping

Step 4: Valuation Check

Step 5: Negotiate and offer

Step 6: Option to Purchase

Step 7: Finalize your Bank loan and Lawyer

Step 8: Exercise the Option to Purchase

Step 9: Pay Stamp Duties and Legal Fee

Step 10: Completion date

Step 1: Eligibility Check on the property you are purchasing

There aren’t any restrictions other than the fact that the buyer has to be 21 years old and above to hold the property under his or her own name. Both foreigners and PRs are eligible to buy as long as they meet the age requirement of 21 years old and above.

This indicates that Landed Properties can only be purchased by:

- Singapore Citizen

- Singapore Company

- Singapore Limited Liability Partnership; or

- Singapore Society

Based on the above definition, Singaporean Permanent Resident (PR) and Foreigners are unable to purchase a Landed Property directly and they have to seek approval from the Singapore Land Authority, through their Land Dealings Approval Unit.

Do take note Foreigners and PRs are able to get an easier and faster approval if they are to purchase any Landed properties in Sentosa Cove. ($1220 Application fee)

Each applicant is assessed on a case-by-case basis, taking into consideration, but not limited to, the following factors:

- You have been a Singapore PR for at least 5 years

- You have a track record of providing economic contribution in Singapore

- Your employment income assessable for tax in Singapore

Of course, there are special cases whereby the property is brought under trust which will share about in another article [Link].

Step 2: Financial Planning

You have to exercise utmost prudence and make sure you don’t overleverage and commit yourself to a property purchase without a concrete financial plan. Any misstep resulting in a wrongful commitment to purchase a property could cost you greatly on both your time and money and we wouldn’t want that to happen.

You will have to:

Determine your maximum affordability by checking your loan eligibility and the maximum loan amount you can take (LTV and TDSR)

Calculate and prepare downpayment and stamp duty required in cash and CPF

Factor in miscellaneous fees such as lawyer fees, mortgage stamp fee, property tax, MCST fees

-

Find out the Loan-To-Value (LTV) of the property

-

For the purchase of a Private residential property, you can only take a maximum housing loan of 75% of the valuation of the property. This is known as the Loan-To-Value.

-

-

Check your maximum affordability and loan eligibility using the Total Debt Servicing Ratio (TDSR)

To encourage prudent lending in Singapore, the Government has implemented the TDSR which is known as Total Debt Servicing Ratio.

This sets a limit on how much you can borrow from financial institutions (FI), who must ensure your monthly repayment for all debts (including mortgage, credit card bills, car loans and personal loans) does not exceed 55% of your gross monthly income.

Account for Downpayment

Since you can only loan up to 75%, the remaining 25% will have to be in Cash and CPF

20% can be in cash or CPF and 5% MUST be in cash

Account for the Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty

These are taxes levied on the purchases of the property in Singapore and the stamp duty to pay will be dependent on 3 factors:

- Purchase price of the property

- Citizenship of all the purchasers

- The number of properties you and the joint purchaser own.

Those under the respective Free Trade Agreement (FTA), Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

- Nationals of the United States of America

Below is a computed table to show the amount of Stamp Duty incurred based on different profile of buyer.

| Profile of Buyer | ABSD Rates from 12 Jan 2013 to 5 Jul 2018 | ABSD Rates from 6 Jul 2018 to 15 Dec 2021 | ABSD Rates on or after 16 Dec 2021 |

|---|---|---|---|

| Singapore Citizens (SC) buying first residential property1 | Not applicable | Not applicable | Not applicable |

| SC buying second residential property1 | 7% | 12% | 17% |

| SC buying third and subsequent residential property1 | 10% | 15% | 25% |

| Singapore Permanent Residents (SPR) buying first residential property1 | 5% | 5% | 5% |

| SPR buying second residential property1 | 10% | 15% | 25% |

| SPR buying third and subsequent residential property1 | 10% | 15% | 30% |

| Foreigners (FR) buying any residential property1 | 15% | 20% | 30% |

| Entities2buying any residential property1 | 15% | 25% | 35% |

| Housing Developers3 buying any residential property1 | 15% | 25%4 (Plus Additional 5% (non-remittable)5) | 35%4 (Plus Additional 5% (non-remittable)5) |

Couple with at least 1 Singaporean Citizen buying their first home will be considered their matrimonial home and the ABSD will not be imposed for the purchase.

FOR EXAMPLE

Singaporean couple with a combined monthly income of $10,000 purchasing a $1 million condo.

Total Upfront fees:

Purchase Price | $ 1,000,000 | $ – | |

Downpayment (25%) | Remarks | ||

Downpayment (25%) | $ 250,000 | 25% | |

Cash (5%) | $ 50,000 | 5% | |

Cash or CPF (20%) | $ 200,000 | 20% | |

Buyer Stamp Duty | $ 24,600 | 4% – $15,400 | |

Additional Buyer Stamp Duty | $ – | 0% | |

Lawyer Fees | $ 3,000 | ||

Total Downpayment + Expenses | $ 277,600 | ||

There are many ways to structure an optimal financial plan to avoid paying hefty additional stamp duties while keeping your monthly repayment low all at the same time.

Having prudent financial planning is the first step to successful property purchase. If you have any queries or concern on how to structure and properly plan your finances to purchase your next dream home or investment property, do reach out to us here are Redprop.

Step 3: Start your Home shopping

Once you have done an eligibility and financial assessment on yourself and your joint purchasers, it is finally time to start shopping for your private resale home!

Before the start of the house hunting, you might first want to:

- Narrow your search by choosing an area

- Check Recent transactions in the project and surrounding area

- Think of an exit strategy for the property

- Future development

Researching and providing insights on the project’s capital appreciation potential, rental yield by analyzing its location, transformation, surrounding schools, amenities nearby, renovation, stack and etc.

Alternatively, you might want to check out the current properties we have for sale. [Current Listings]

Step 4: Valuation check

Obtain a Valuation from the bank on the property that you’re interested in before you commit as you have to bear in mind if the valuation is unable to match your purchase price.

The remaining difference between your offer price will have to be paid via cash and cash only. This is known as the Cash Over Valuation (COV).

- Purchase price – Valuation price = Cash Over Valuation

To avoid such situations where you need to prepare more cash, our RedProp team has a wide network of buyers which can provide the best valuation for you!

Step 5: Negotiate and Offer

Now that you’ve settled on the dream home, it’s time to get down to the nitty-gritty which is the PRICE. However, most of the times, emotions are what really drives our purchases, and this could result in overpaying for a certain property. Hence, it is very important to know the market price and negotiate for the best deal.

After settling on the price, you will have to pay an Option fee of 1% of the offer price either by bank transfer, Cashier’s Order or Cheque along with the Offer to Purchase stating your terms and conditions. This is an indication of interest from the buyers to the sellers.

At Redprop, our professional consultants will help to keep your emotions in check and secure the best price for our buyers. We have also drafted and negotiated countless deals and we will put our expertise to use to properly draft the offer and input terms and conditions we have negotiated to protect the interest of our clients.

Step 6: Option to purchase (OTP)

Once buyer has accepted your Offer to Purchase and 1% Option fee, they will issue you the Option to Purchase (OTP). Once the OTP is issued, according to the law, the sellers are obligated to sell to you if not they will have to face legal consequences.

You will then have 14 days (standard) which is known as the option period to finalize and make the necessary preparations which I will touch on at the next step.

- TAKE NOTE that the option period of 14 days is not fixed and could be negotiated to a longer or shorter period depending on your circumstances*

If you decide to back out on the purchase, you will have to forfeit the 1% option fee previously paid to the seller.

Step 7: Finalize your bank loan and lawyer

After receiving the Option to Purchase, there are a few things you will have to do:

- Engage a trusted Conveyancing Lawyer

- Obtain a Letter of Offer from the bank for your home loan

In Singapore, it is mandatory to engage a conveyancing lawyer for the Sale and Purchase of a property.

It is important to compare conveyancing rates and also have access to a network of bankers which could provide the best valuation for the property of interest.

Not sure of where to find? You can reach out to us here to tap onto our network.

Step 8: Exercise the Option to Purchase (OTP)

Once you have finalized your home loan, you will receive a letter of offer for the housing loan and engaged a conveyancing lawyer for your Private Resale Residential property purchase, you can now exercise the OTP.

To exercise the OTP, you will have to pay 4% of the purchase price and proceed down to the engaged law firm to sign the OTP.

Step 9: Pay Stamp Duties and legal fees

Within the next 14 days after exercising the OTP, you will have to pay the stamp duty and other legal fees applicable. Stamp duty will have to be paid in Cash first, and you can opt for a reimbursement from your CPF on a later date.

Step 10: Completion Day

Congratulations! You are officially the new registered owner. On this date, you will have to head down to the law firm to collect your house keys and pay the remaining 20% using either cash or CPF. Concurrently, your 75% bank loan starts on the completion date as well.

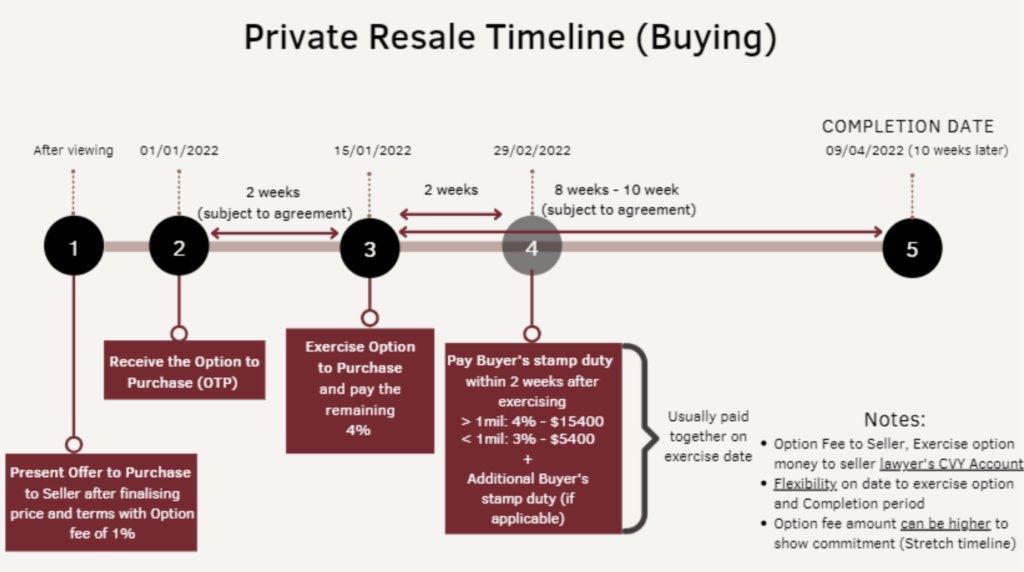

Below is the timeline and summary of the whole purchase process for private residential resale property:

- TAKE NOTE that the whole private residential resale timeline can be flexible depending on whether the seller or buyer needs extra time to prepare the cash or whatever the reason is as long as both sides agree to stretch the timeline.