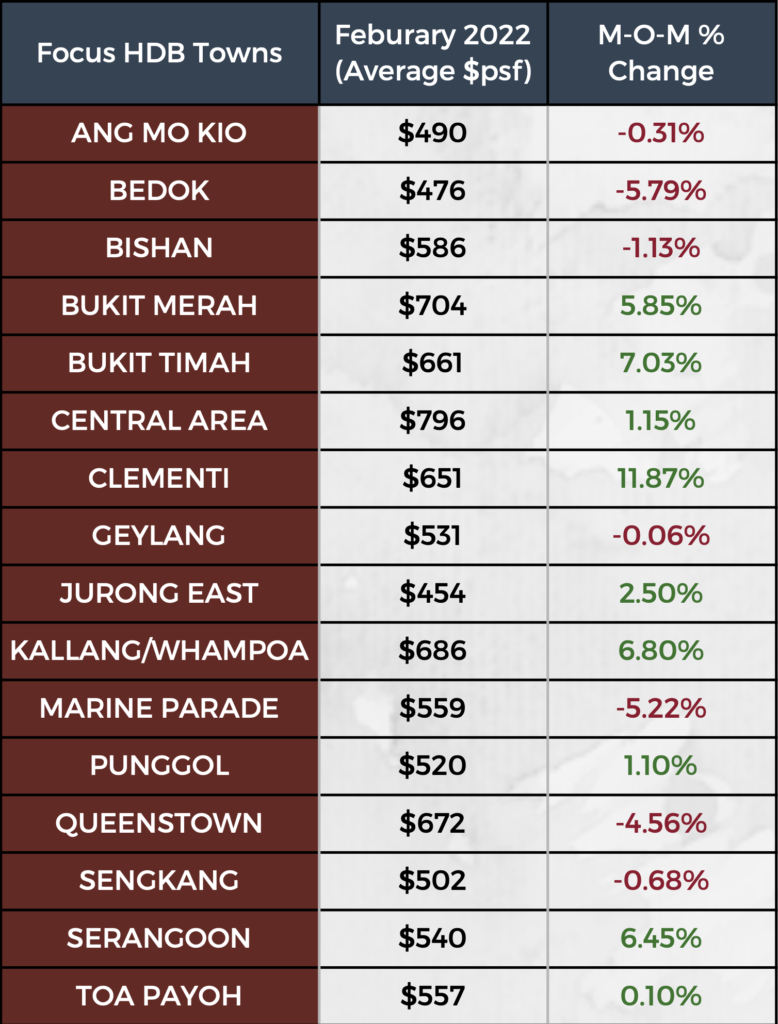

Downward Pressure for HDBs with Supply Increase

HDB at peak prices in 9 years & return of Cash Over Valuation (COV)

Demand from PRs, buyers looking for space and those affected by delayed BTOs

To curb skyrocketing HDB prices, HDB is ramping up the supply of BTOs

Estimated launch of 100,000 BTO flats from 2021 to 2-25

120% more supply of ready flats from HDB reaching 5-year MOP for the next 8 years

From 2020 – 2030, there will be ~20,000 MOP flats annually, compared to 9,000 flats previously

OUR TAKE

It is a good time for HDB sellers looking to sell their flats to upgrade or cash out now.

If this opportunity is missed, it is likely that sellers will need to wait for the next cycle when the market corrects.

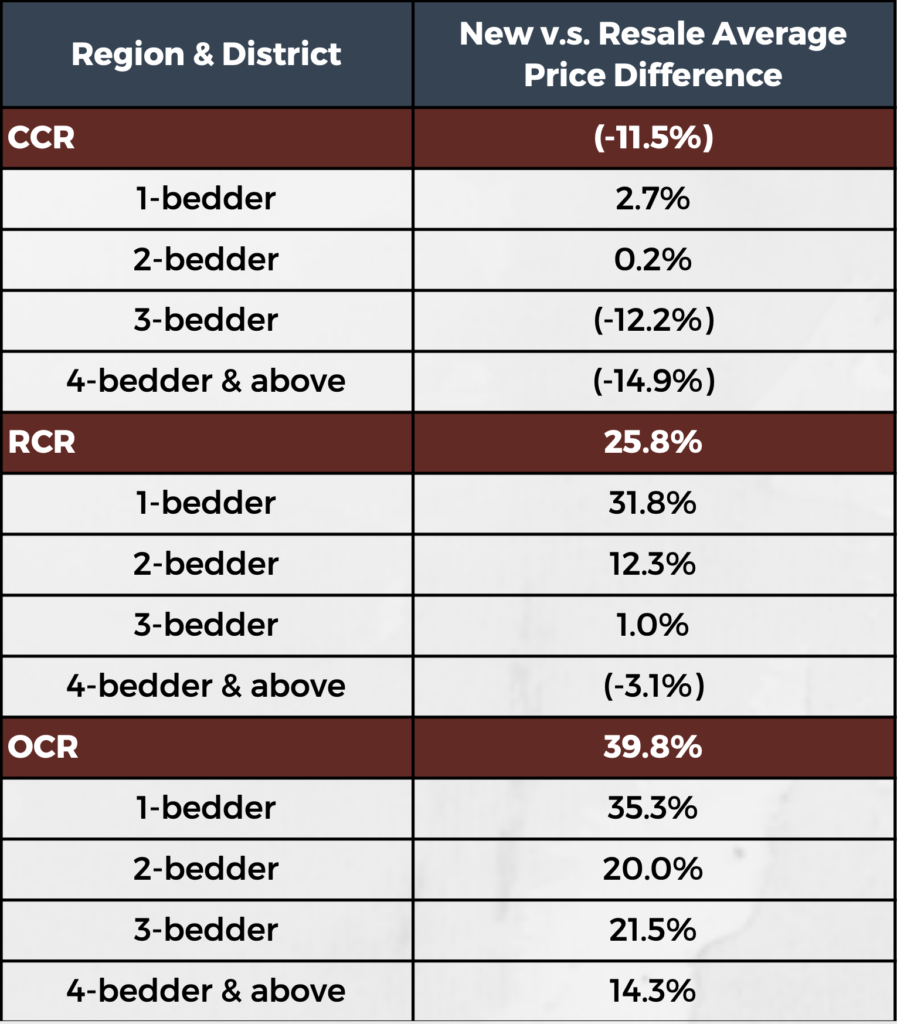

Are there still good deals in the New Launch Market?

High PSF Prices, but Reasonable Price Quantum

In terms of psf, new units are indeed more expensive, prices at an average of 31% higher than resale units. However, interns of absolute price, there are still areas and unit types where new units are priced lower than the older, resale units.

Opportunity

Market Gaps in the CCR/RCR

While this price gap might be due to smaller floor areas, this also means we are able to buy brand new condos at an affordable price range and at a good value. For example, in The Central regions, the price of a brand new 3BR/4BR+ could be similar or even lower than its resale counterparts,